/

Mindset

The power of rapid changes

Technology changes fast ‑ people and organizations don't.

/

Taking a broader perspective, including competencies, culture, mindsets and behaviour change, increases the value by 15 times compared to the value of focusing on the technology alone.

Think about going from traditional business reporting to a data science approach. Or introducing a new business system. Or changing your company's position in the value chain. Or getting your customers to prefer a different channel for customer service. The task may seem daunting, requiring new technology, upskilling of employees, persuasion of customers and business partners and new working processes.

/

Traditional change management frameworks, such as the ADKAR model, McKinsey's 7S model and Kotter's 8‑step change model all provide guidance and are widely used. Still, 70% of all major transformations fail.

The reason? Too many organizations fail to acknowledge that 20% of change is about frameworks, plans, road maps and spreadsheets and 80% about execution.

A clear vision of what you are trying to achieve and why it is essential is needed. You have heard it many times, it is the easy part. But getting the organization's buy‑in isn't. Communication must resonate with audience, relate to their particular situation and strike an emotional string. Emotions are exactly that ‑ something that creates motion.

Employees, customers or business partners need to understand how their particular working day will be affected. And they need the right tools and skill sets to master them.

Start small, create success stories and communicate them. Be open about the implications of the change, detail the desired behaviour, uncover barriers and underlying motivation, address them and reward those who change.

Given the right mind‑set, solutions can prove surprisingly simple.

Veidekke Company adoption of new technology

Tech adoption at an organizational level can be a slow affair. It is not only about configuring the new system and training the employees. The real challenge is employee buy‑in and changing the way work gets done.

SpareBank1 Customer service concept

First‑time homebuyers are a large customer group for SpareBank 1. However, the bank experienced considerable churn when this group made their next property investment. Quantitative analyses did not provide the clues. In a series of in‑depth interviews, Mindshift revealed the underlying drivers for switching to other banks (price was not the driver). The project resulted in a series of measures, one of which was changing the advisors’ communication with customers about to make their next home investment.SpareBank1 Behaviour design for increased conversion

Getting young adults to sign up for pension savings was a challenge for SpareBank 1. Digital solutions to educate customers in pension regulations, how installments affect their future pension and the details of how it is calculated, resulted in poor conversion rates. Mindshift applied behaviour psychology to develop a concept where the pension calculator was replaced by a simple digital solution, tapping into the target groups underlying drivers. The new approach resulted in an increase of more than 40% in average amount of payment installed.Service Design SpareBank 1

Mindshift bisto Sparebank 1 med sin satsing mot familiesegmentet. Et element i dette var en egen side for samlivsbrudd. Denne effektiviserer en prosess som er svært tidkrevende for både bank og kunde, ved at den guider kunden gjennom alt som har med økonomi å gjøre. Den legger opp til ett møte med rådgiver, som ved hjelp av den digitale løsningen blir svært effektiv.Resultat: Løsningen bidrar til at det holder med 1 rådgiversamtale ved samlivsbrudd, mot ca 3 møter før løsningen ble lansertKLP Improving self-service

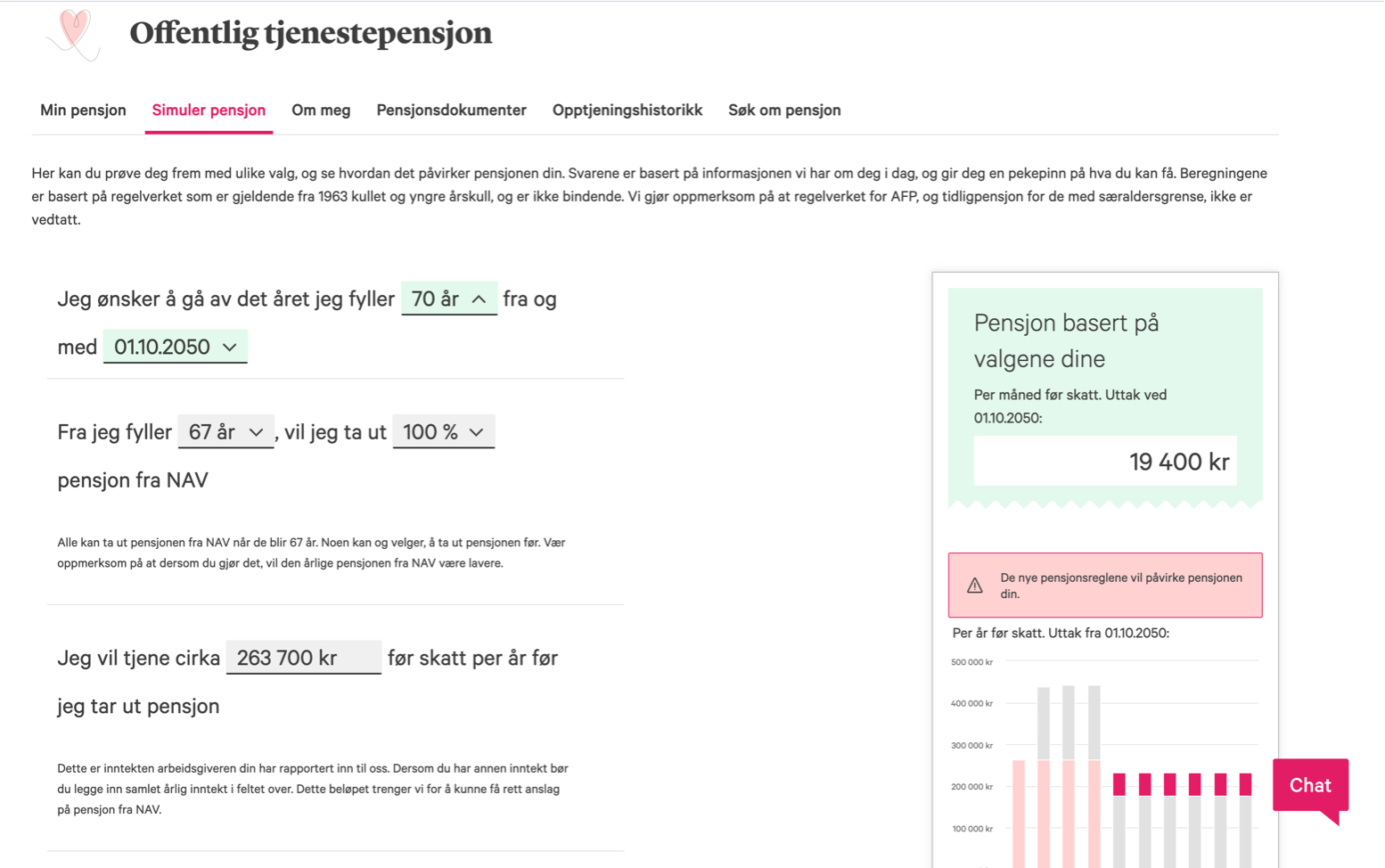

KLP’s traditional retirement pension calculator led to member confusion and generated a lot of traffic to the call centre. Mindshift assisted KLP with development of a new digital pension guide, which provided members with different scenarios and how each would affect their pension benefit. The pension guide resulted in a huge reduction of pension benefit related calls, estimated at approximately 25%.